|

Canadian Senior Living &

|

Seniors Are Not Sexy

Society and industry often overlook aging, but seniors' needs—wills, estates, caregiving, and housing—are too important to ignore. "Seniors Aren’t Sexy" challenges the stigma and highlights why the business of aging deserves more attention.

Continue Reading->Featured Staff

Sherwood House welcomes Ardelle and DauneneWe would like to welcome Duanene and Ardelle to the Sherwood House family!

Continue Reading->

SeniorCareAccess launches the Senior Care Insights YouTube channel

Discover how retirement homes offer independent living, private suites, and flexible services, while long-term care homes provide government-subsidized, 24-hour medical care for seniors with complex health needs. Explore costs, funding options, admission processes, and regulation standards. Perfect for families researching senior living options like nursing homes or assisted living in Ontario.

Continue Reading->

Chateau Glengarry your alternative retirement home near Ottawa, Montreal and Cornwall

Discover the benefits of retirement living outside big cities. Chateau Glengarry in Alexandria offers affordable, peaceful, and community-focused senior living just a short drive from Ottawa, Montreal, and Cornwall. Experience quality care and a true sense of belonging.

Continue Reading->

Comprehensive Hearing Care in Burlington, Oakville, and Hamilton

Get the best hearing care services in Burlington, Oakville, and Hamilton at Hearing Well Matters!. From hearing tests and tinnitus treatments to hearing aid fittings and mobile hearing services, we offer comprehensive audiological care to meet all your hearing health needs. Book your appointment today for personalized solutions and improve your quality of life.

Continue Reading->

Galaxy Medical Alert Systems: A Lifeline for Canadian Seniors

Discover the benefits of Galaxy Medical Alert Systems for seniors in Canada. Learn about key features like fall detection, GPS tracking and types of devices, providing safety and peace of mind for independent seniors and retirement homes.

Continue Reading->Featured Community

North York's specialized Dementia Care Residence - Cedarhurst Dementia CareFor close to 20 years, Cedarhurst Dementia Care Home has continued to maintain its reputation as a small, charitable, not-for-profit profit retirement home designed with a home-like environment, specifically for those individuals living with dementia. Learn More->

Featured Pet

Sunset on Summer Open House

Come celebrate Sunset on Summer with us during our Open House! Saturday, September 21 · 1 - 3pm EDT

Continue Reading->

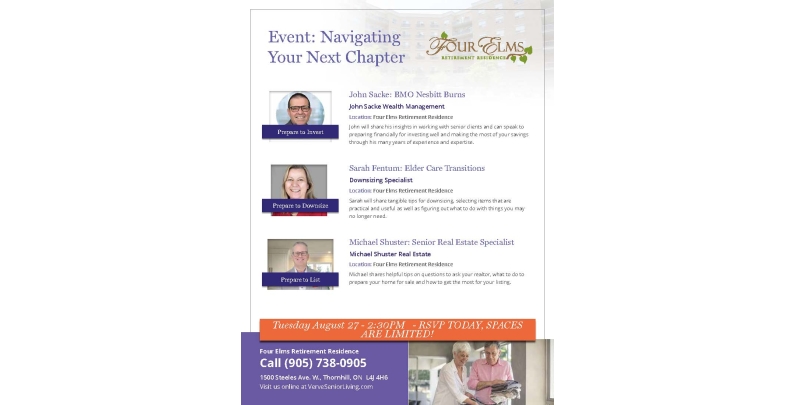

Navigating Your Next Chapter - Expert Tips for Seniors Transitioning to Retirement Living

Join us for a comprehensive Downsizing Event tailored to help you navigate the transition with ease! Our expert panel includes a Seniors Real Estate Specialist (SRES) sharing insights on preparing your home for sale, selecting the right realtor, and understanding commission services, alongside a downsizing specialist offering practical tips on organizing, managing belongings, and simplifying the move. A financial advisor will also cover how to prepare for retirement living, make your money go further from selling your home, and how to choose a trusted financial advisor.

Continue Reading->The Lifestyle55+ Affiliate Training Program: Empowering Professionals in Senior Services Across Canada

As Canada’s senior population continues to grow, there is a rising need for professionals equipped to address the unique needs of older adults. The Lifestyle55+ Affiliate program, offered by Lifestyle55+ Training, is designed to empower various service providers with the skills and knowledge to support seniors effectively.

Continue Reading->Ageing the importance of understanding ADLs

Offering an understanding of the Activities Of Daily Living, who it effects, resources to help and more.

Continue Reading->Past Articles:

Limited Spaces Available for our NEXT Issue!

Contact us for advertising rates and article submission at submissions@senioropolis.com

.png)